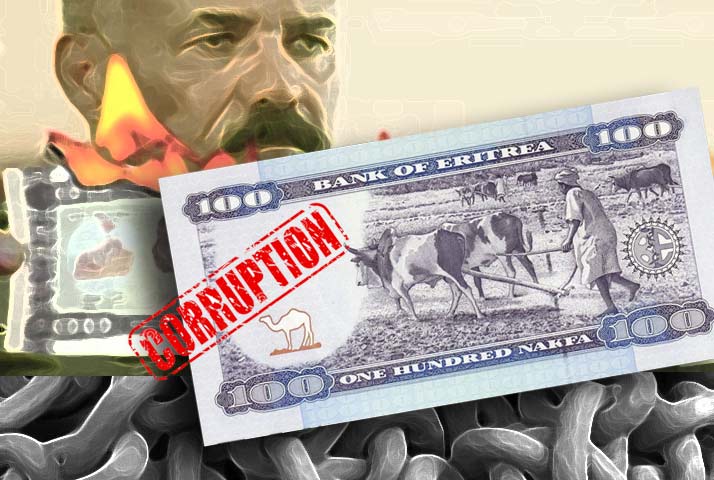

Eritrean Depositors Lose Control of Their Funds

In a move reminiscent of past campaigns, over the last few weeks, the Isaias Afwerki’s government has arrested many people and sealed their businesses. Government sources indicated the reason for the far-reaching arrests is to investigate alleged crimes of corruption.

The doors of at least 200 businesses in Asmara and other places in Eritrea have been sealed by the government on charges of alleged corruption. The charges seem to be limited to businesses owners who issued checks to meet their transactional obligations, but the banks didn’t honor the checks.

Since the government changed the Nakfa currency bills two years ago, it has effectively taken control of all private and business assets entrusted to the banks. At the time the government claimed the move to achieve its goal of bringing Eritrea to the 21st century by limiting cash transactions. Eritreans were forced to use Bank checks instead of paper currency. However, in a country with a high illiteracy rate, and an almost non-existence experience in dealing with checks, the decision practically froze the already weak economy.

Banks who received checks with amounts exceeding the allowed amount were ordered to report the issuers to the security department who arrests the people for interrogation.

Contrary to known banking procedures all over the world, Eritrean banking officials do not disclose to the issuers, why their checks were not honored. Also, the depositors do not know what rules they violated, or the reasons for their arrest. No one including the special courts and bank officials seems to be up to date with the ever-changing rules.

The president’s office is the final and the only arbiter of the bank transaction rules.

Since 2015, depositors have practically lost free access to their funds in the banks; the government has full control of the entire money supply in the banks.

The latest victims of the new rules are Eritreans from the diaspora who hold bank accounts in Eritrea; the rules demand that account holders must appear in person to make a withdrawal. However, it is not known whether dully delegated persons can withdraw limited amounts on behalf of account holders to meet certain obligations.

This year, the tourism industry was the hardest hit due to the uncertainty of the security situation in the country. In addition, the high risk of exchanging hard currency in the black market has discouraged many potential visitors from traveling to Eritrea.

The official exchange of the US dollar is around 15 Nakfa to the dollar, 2 Nakfa lower than the black market.

Related Reading

Eritrea’s New Capital and Social Control through Currency Change

Shortage of Nakfa Bills Reported Outside Eritrea

Water: Black Market Economy of Eritrea

Eritrean Businesses: Between Loyalists and Others

Awate Forum