Sunridge CEO: 99% Of Eritreans Support Our Operations

It has always been the mission of Awate.com to work hard to inform its readers on everything the government of Eritrea and its collaborators hide from the people. Awate.com was established for that reason.

We monitor the mining sector seriously simply because of its corrupt nature, undisclosed dealings, the long lasting environmental disaster it brings with it, and the slave labor it depends on to show unjustified profits to its shareholders.

In addressing these specialized issues, we are fortunate to have financial and subject matter experts in awate team who tirelessly work to help explain to our readers the intricacies of how mining operations are conducted and financed as well to offer a context for the subjects we raise.

Over the years, we have monitored mining activist in Eritrea and developed considerable subject matter expertise in so far as mining is considered. The researches and interviews we conducted with former employees of Bisha Mining Company, ENAMCO, NEVSUN, Eritrean Ministry of Mining, national service conscripts and others, along with our sources in Eritrea, have provided us a vantage point to share our findings with our readers.

When approached by human rights group, law firms, investors, and international organizations, and mining community, and the media, we do not shy from providing our considered views and analysis on mining activities and its implication in Eritrea. We bring a viewpoint to the discussion as we articulate our vision of the future of mining in Eritrea. We are bound by non-disclosure agreements not to publish documents that could shed light to the corrupt nature of mining in Eritrea. We also honor our promise to protect our sources everywhere. Despite all these constrain, we remain true to our mission of reporting factual, accurate, and timely development we deem relevant to the Eritrean people.

With such information we hope to raise the awareness and encourage debate of major issues that concern the people. But such information also attract spoilers, mostly government operatives who mimic a few terminologies associated with the stock market and especially with financing and cast doubt on the veracity of the information. Knowing a few terminologies is not enough to engage in a specialized debate; that is why we decided to write this article to help inform those who are concerned about the well-being of their people and country.

For obvious reasons, neither awate.com nor Gedab News offers investment advice or insight. We can only suggest that investors, whether they invest in Eritrea or elsewhere, to be ethical investors and at the same time warn them of the volatile nature of investment in Eritrea, which is ruled by an unelected rogue regime.

After the financial crisis of 2008, more people are choosing to invest in socially responsible companies. This is not only because there is a strong business case urging investors to do the right thing, but in the long run, these ethical companies outperform the market. With the development of social media, it is difficult for companies to get away by utterly disregarding the environment, and issues of human rights and labor law. In the long run, it is simply not a sustainable business strategy for a company to do well by employing children, polluting the environment, or using forced labor such as in the case of Nevsun, which allowed its top five executives to take home $5 million dollars last year. More and more enlightened investors are demanding accountability and transparency in the corporate governance and management of the firm they invest in. That should be debated by all stakeholders and victims of irresponsible corporations.

Africa Rising. So will post-PFDJ Eritrea

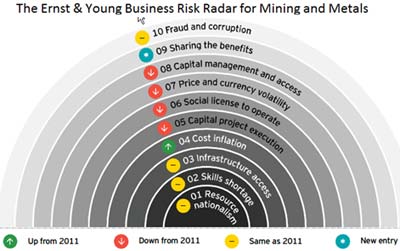

In a continuation of the 50 years old struggle against colonial rule and exploitation, a new grassroots movement, often described as resource nationalism, is taking root in emerging economies such as South Africa, Brazil, Indonesia, and Vietnam and others to take assertive stance to regulate the mining activities of multinational corporations. The aim of the initiative is to secure greater financial, regulatory, and operational control over mining activities by strengthening policies and laws that give them greater say in how their natural resources are managed. They are demanding higher taxes and royalties, greater state equity and indigenous participation, favorable contract renegotiation, technology transfer, and value-added processing of natural resources before exporting it to other countries.

Ernst and Young, the global management consultancy firm, in its report “Business Risks in Mining and Metals of 2012/13”, states that “resource nationalism” is the biggest risk facing foreign firms in Africa with governments “going beyond taxation in seeking a greater stake from the sector, with a wave of requirements introduced around mandated beneficiation, export levies and limits on foreign ownership.” (i)

Similarly, for the past 50 years, the Eritrean people have been at the forefront of national liberation movements to liberate themselves from the yoke of colonialism. However, instead of controlling their destiny and having a say in how their country is governed, they found themselves living under an oppressive regime. They don’t have a say on the nonexistent basic human rights, let alone on how their natural resource is managed.

Similarly, for the past 50 years, the Eritrean people have been at the forefront of national liberation movements to liberate themselves from the yoke of colonialism. However, instead of controlling their destiny and having a say in how their country is governed, they found themselves living under an oppressive regime. They don’t have a say on the nonexistent basic human rights, let alone on how their natural resource is managed.

Much of the Eritrean resistance to the ruling party is composed of open minded citizens who have the best interest of their country at heart. They believe the natural wealth of their country should be developed in an ethical and environment friendly manner and in a way that benefits the people, particularly the inhabitants of the regions that are being most impacted by the development activities. Only then can the mining sector fuel the development of their cash-strapped underdeveloped country and catch up with the rest of Africa.

In light of the corrupt nature of mining in Eritrea, we therefore unreservedly believe that the resource nationalism movement is rightly justified in asserting people’s right to have a say in how their natural resources is developed.

No Honor Among Swindlers

Given the fact that Isaias is known to make all important decisions with little input from those who supposedly advise him, it is not surprising to see how the Eritrean regime was swindled by Nevsun when it overpaid twice the amount of money to acquire 30% equity in Nevsun.

We have seen how a law firm in New York successfully sued Nevsun in US courts on behalf of stockholders by alleging that it misled investors by overstating the Bisha mine’s potential reserve and manipulated production schedule to show unrealistic quarterly earnings.

Nevsun quickly settled out of court to avoid the disclosure of evidence concerning its corrupt dealings with the dictator in Asmara from becoming public in an open court proceeding. Nevsun had inflated the value of the Bisha mine in order to have an upper hand in the arbitration process to resolve the dispute of how much the Eritrean ruling party (PFDJ) owned ENAMCO had to pay for the 30% equity.

Two months after an agreement was reached, Nevsun unceremoniously revised down its estimates of the Bisha gold reserve as the earning it was reporting was no longer sustainable. As a result, Nevsun’s stock value tumbled by 50% and a class action lawsuit on behalf of shareholder ensued.

Nevsun reported that taxes, customs, and concession fees that would otherwise have been paid by Nevsun to the Eritrean treasury were used to offset the payment of US $253.5 million that ENAMCO would have paid to acquire the 30% equity in Nevsun.

We do not believe the regime is that incompetent to be duped by Nevsun, especially when it comes to extorting money as it does from its own citizens. Rather, we believe the regime, facing UN and EU sanction and international isolation, had no choice and was (and still is) desperate for hard currency to equip its security apparatus to crush its own people and prolong its rule. To avoid the repeat of such a fiasco, last week the regime signed a shareholder agreement with Sunridge (another Canadian corporation) that specifies the exact amount of money ENAMCO needs to pay to acquire the 30% equity. Further, to help keep Sunridge afloat, ENAMCO also agreed to pay 33% of the development cost.

Center Vs Periphery

Throughout the history of Eritrea, people who live in the peripheries have suffered more than their compatriots who live around cities where foreign eyes are present, and where the largest portion of the benefits are reaped. This has been happening during the struggle era when the peripheries went through untold miseries while city dwellers had a relatively easier life. Once the troubles extended and reached to the city, the whole attitude of the people went through a drastic shift, bad news for oppressors and unscrupulous businesses.

That has been the case with the mining industry. Almost a decade after Nevsun started its operation in the remote Bisha area, the inhabitants had to be uprooted with the pretext that the region is uninhabited. The truth is, the inhabitants of the area were exiled beginning in 1967 when the Ethiopian government of the time started its scorched earth policies torching villages, farms and killing cattle and people. Tens of thousands of people from the surroundings of Bisha escaped to Sudan and settled in makeshift camps where they are still living 23 years after the independence of Eritrea, almost half a century since they were first driven out of their homes.

In Bisha, the graves of the region were exhumed unceremoniously by getting a pretend consent of the people who would not dare oppose any move sanctioned by the Eritrean government. The water level is depleted and now the nomads who roam in that area have to depend on brackish water that is suitable neither for cattle nor for humans. The job opportunities are given to select PFDJ security operatives while the inhabitants are neglected, not given any training to cope up with the demand of the mining industry and be part of the operation, and they are culturally devastated.

As we have reported in Gedab news, a group of Eritreans from the Afar region accused the regime of systematically targeting the Afar people in order to remove them from potash and other precious metals rich area of Colluli.

Colluli Mining Share Company (CMSC), a joint venture between the Australian South Boulder Mines Ltd. and the Eritrean National Mining Company (ENAMCO), was awarded an exploration concession area that spans 400 sq. km within the Danakil Depression, an area South Boulder Mines describes as “flat, arid desert with sparse population and minimal environmental / social issues.”(ii)

South Boulder Mines was able to convince investors that the UN sanction on Eritrea will not impact its exploration and stock traded as high as $5.8 in March 04, 2011. Today it is trading at $0.16, or, 2% of its all-time high.

Sunridge Will Repeat Nevsun’s Damages

From our research we have learned that Nevsun secured a waiver from president Isaias not to abide or worry by the environmental safeguards. As a result, Nevsun has done huge human and environmental damage in Bisha rendering the region a waste. In a gesture to remedy the damage, when Nevsun attempted to compensate the people of Bisha, the PFDJ party boss blocked their efforts.

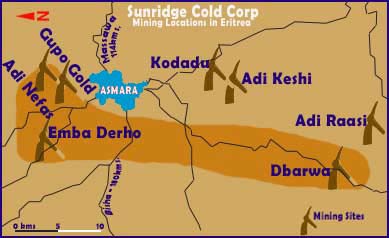

Now Sunridge is taking the devastation to the surroundings of the capital city, Asmara. Though Sunridge takes false pride and makes unsubstantiated claim for being an environmentally responsible company, the situation is explained by the following excerpt of an interview that Eric Coffin had with Mike Hopley, an executive of Sunridge.

Eric Coffin: Do you have any concerns about Asmara – the project that is – being too close for comfort to the capital city region? I mean, obviously, your situation is great in terms of infrastructure since it’s relatively close to the city of Asmara. Are the locals ok with you being on the outskirts, or are there people freaking out where you might be digging a big hole?

Mike Hopley: That is a good question. It is true that there are a lot of inhabitants within a few kilometers from the operation but surprisingly, the actual number of people disturbed by our proposed mining operation is quite small. The operation will be four separate mines and one centralized operating facility mill and despite this, it is really minimal disruption to people. We are not moving graveyards and dozens of houses; there is probably something in the order of 15 houses that would be impacted down in the south in one operation, but really it’s pretty minimal. Also, there is an interesting philosophy in the country that is sort of unusual to American or Canadian thinking. The people of Eritrea are very supportive of their government.

That means what the government is supporting – and they are obviously supporting our operation – is assumed to be good for the country and so therefore, there is very minimal opposition to our project. There will always be some opposition to any large industrial operation but, generally speaking, 99% of the people are supporting our operation. (iii)

So, Mr. Hopley believes that 99% of the people support the government. He seems to have forgotten to account for the victims of the government who are being exposed to all sorts of risks all over the world. We are not sure if Mr. Hopely added the refugees in Sudan, Lampedusa and Israel, for example, to the 99% who support the government. Obviously Mr. Hopely’s “scientific sample” must include the 4,000 Eritreans, who according UN reports, flee the country every month to escape ruthless repression, including unlimited forced labor for the government projects that include the mining sector!

The investment community attracts savvy people who always do due diligence before investing in anything. We do not know in which world Mr. Hopely lives, but we wonder if he knows that his incredulous statement can be easily challenged by potential investors by simply googling “human rights Eritrea.” The search yields millions of results, something that he or the regime supporters will never be able to erase or explain away. If they search further, they will find out that the Eritrean people live under a dictatorship that uses forced labor to build the Bisha mine run by Nevsun.

The regime, in partnership with Sunridge, is poised to do the same in the densely populated outskirts of Asmara. But this is not going to be easy, research Eritrean history of 1975 and you will know what happens when disaster reaches the capital city. For the moment, what needs to be understood is that Sunridge’s mining operation is located in the vicinity of Asmara, in a densely populated region around the villages of Emba- Derho, Adi-Nefas, Gupo Gold and Debarwa, 12 to 20 kilometers from Asmara. Unlike Bisha which is located in the semi-deserts of Western Eritrea, over 100 miles from Asmara, it is “out of sight out of mind” to many who do not follow mining activities in Eritrea.

Regulation Vs Anarchy

We understand that engaging in such debates, particularly its specialized part, requires basic knowledge of how firms are financed, from start up to going public, and enough knowledge to distinguish between a regulator and an exchange.

Canada has two main exchanges and so does the US, South Africa, Egypt, Kenya and many other countries. But companies do not file financial statements like 10 Q or 10 K with the exchange, but rather to their regulators; many countries, including Canada, do not have strong regulators like the US Securities Exchange Commission (SEC).

In order to be listed and be publicly traded in any exchange, an entity has to be approved by the authority that regulates the securities market. In the US, this is the responsibility of the SEC.

A simple explanation states (iv): “Canadian securities regulation is managed through laws and agencies established by Canada’s 13 provincial and territorial governments. Each province and territory has a securities commission or equivalent authority and its own piece of provincial or territorial legislation.

…. concerns with the provincial system of securities regulation has led to repeated calls for a national securities system in Canada. Currently, the Government of Canada is working towards establishing national securities regulatory system that it says will provide:

- better and more consistent protection for investors across Canada;

- improved regulatory and criminal enforcement to better fight securities-related crime;

- new tools to better support the stability of the Canadian financial system;

- faster policy responses to emerging market trends;

- simpler processes for businesses, resulting in lower costs for investors; and

- more effective international representation and influence for Canada.”

Until Canada established a SEC-like federal regulator, rouge and unscrupulous Canadian firms, especially mining companies like Nevsun and Sunridge, will continue dealing with tyrants and dictators to make money without any concerns for the environment, labor, and issues of human right.

Canadian companies have relatively weak disclosure and reporting requirements: officers and directors are not obliged to disclose inside trading (the purchase or sale of the securities or how much option they hold) in the company they manage. If Sunridge was registered with the SEC, it would have been required to disclose the names of interested buyers , and its relationship with Wanbao (A Chinese company) which was asked by the Eritrean government (basically by Hagos Keisha, the financial chief of the ruling party) to consider purchasing Sunridge, but Wanbao backed out for many reasons, geo-political consideration being one. Wanbao held stakes in Myanmar and was embroiled in a land acquisition dispute with 26 villages whose protests halted the development of the mine.

In a Wall street Journal interview, Wanbao chairman Chen Defang stated that he was “humbled by admitting error in previously ignoring community opinion.” The mine has since resumed operation after the company shifted tactics and started working with Aung San Suu Kyi, the celebrated leader of the Myanmar opposition.

Mr. Defang pledged that Wanbao will create local jobs, support small businesses and raise the amount of compensation for land acquisition from $600 per acre to $700–1200 per acre, depending on the use of the land. If Wanbao’s change of conduct is any indication, we would like to believe that Wanbao has learned a lesson form its shift and would focus on fostering community relation rather than its previous dealings with the military junta in Myanmar. We also would like to believe that its withdrawal from Eritrea was motivated by similar considerations.

Rescuing Sunridge

In recognizing Sunridge’s challenges in securing financing and its inability to go to production on its own, Eric Coffin, the editor of HRA Advisories, thinks the next best thing for Sunridge is to position itself as an attractive target for takeover, which is what Sunridge is doing.

According to its 2013 annual report, Sunridge retained a Canadian investment banker on May 2013 to act as an advisor for a potential sale of its asset in Eritrea, or possibly the company. To attract Chinese investors, Sunridge translated its investment brochure into Chinese. We believe the potential buyer was Wanbao. If not, since Sunridge is a Canadian company, it would have at least translated its brochure into French if it were seeking Canadian investors. Also, being aware of SEC regulations, Sunridge avoids dissemination of investment solicitation materials in the US.

At the writing of this article, Sunridge stock (SGC.V) is trading at $0.20 with a 52 week high and low of $0.12 and $0.31, respectively. Its market capitalization is about $US 51 million, or about 2.5 times its book value with a reported price to book of $2.48. Its exploration and evaluation assets is 91% of its total assets or $18.6 million and $20.4 million, respectively.

Incidentally, Nevsun was successfully sued in NY because Nevsun is dually listed in the Toronto and NY securities exchange. Nevsun met SEC requirements to be listed in the NYSE to access the US capital market for equity and debt financing

Since Sunridge is shutout even from the Canadian capital market, its only option was to borrow at a very high interest rate. Sunridge has to give up substantial equity in terms of ownership, for $5 million finance, one could at least suspect who was doing the placing. The financing did not come from a reputable or well-known investment banks. Some people are enamored with the word “private placement” without knowing what it really means, but google proves the financer of Sunridge on the above deal is a one-man company listed as Tempest Capital that secured the loan. In return, Sunridge paid a hefty price to the secure the financing of about $5 million. As mentioned by Gedab, Sunridge issued 4 million shares of broker warrants (v) as the share capitalization page of Sunridge shows.

So far, UN and EU sanctions do not apply to mining companies in Eritrea. However, the fact that a country is under UN and EU simply does not attract new potential investors. Those already invested usually cut their losses and flee just like what Chief Executive Officer Doug Jones of Chalice Gold Mines Ltd. (CHN) (v) said during the forced sale of Zara mine to China’s SFECO clarifies: “The main reason for the sale is the difficulty in raising development funds in the current market,” he said. It’s “a problem exacerbated by the UN sanctions against Eritrea.” (vi)

As we have reported previously, SAFECO has not reported in its website any mining activities in Eritrea as it is reluctant to invest the needed capital expenditure to develop the Zara mine.

Related Links:

Sunridge’s Income Statement, Balance Sheet, and Cashflow

Sunridge’s Financial Ratios

References:

(i) Business risk facing mining and metals (last accessed on July3, 2014)

(ii) South Boulder Mines Ltd. (last accessed on July 3, 2014)

(iii) Interview with Mr. Hopley (last accessed on July 3, 2014)

(iv) Canadian Securities (last accessed on July 3, 2014)

(v) Sunridge issued 4 million shares of broker warrants (last accessed on July 3, 2014)

(vi) Bloomberg: …UN sanctions against Eritrea (last accessed on July 3, 2014)

Awate Forum